Supervisor: Luyao Zhang, Assistant Professor of Environmental Policy

Project Description

Direction Ⅰ, conducted by Haoxin Yu

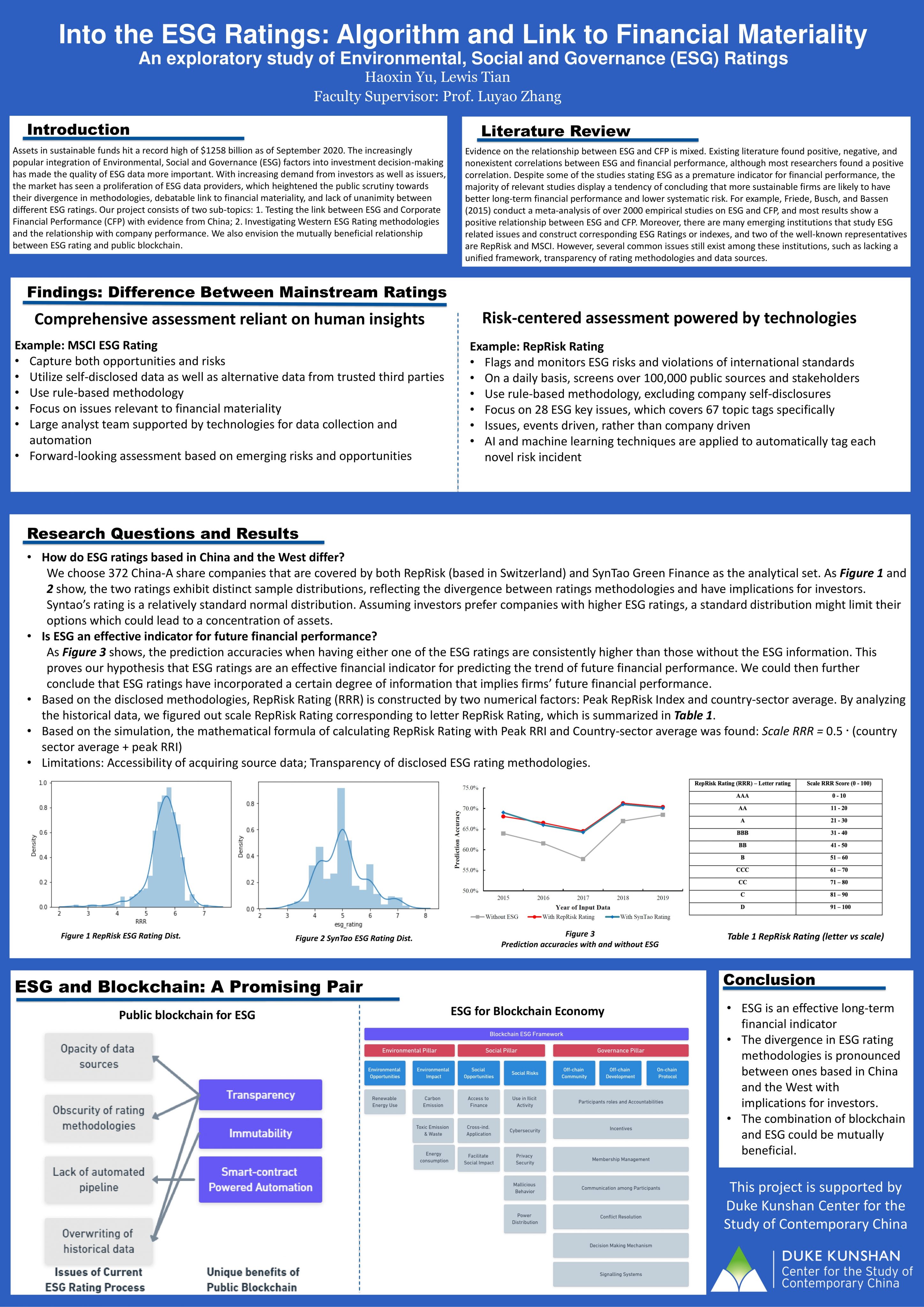

ESG is the core concept in the field of green finance that has attracted much attention in recent years. Based on traditional financial indicators, ESG aims to integrate environmental, social, and governance factors. By examining the potential for long-term and sustainable value growth of the company, it can effectively help prevent and control downside risks, obtain long-term returns, and discover economic growth. However, there are currently many international ESG rating systems lacking a unified framework, transparency of their rating methodologies, data sources, and a consensus on how to evaluate the ESG related risk profiles. This research intends to find how ESG Rating is constructed from company performance. In the study, we mainly did the review and illustration of MSCI & RepRisk ESG Rating. We can identify limited mechanisms that could hinder us to simulate ESG rating under various circumstances. For RepRisk, we could only identify the formula in the last step of generating RepRisk Rating: Scale RRR = 0.5 𑁦 (country sector average + peak RRI). For MSCI, we could only identify the rating construction methodologies based on various factors. However, we believe that the blockchain is supportive of eliminating these limitations, and we aim to explore the possibility of constructing an ESG rating system for blockchain for our next step.

Direction Ⅱ, conducted by Ziliang (Lewis) Tian

With growing awareness of sustainability, the field of Environmental, Social and Governance (ESG), has been attracting mainstream investors and researchers. Many previous studies have found inconclusive or mixed results on the relationship between ESG ratings and firms’ financial performance, which are mainly attributed to their varied markets, time horizons, and sources of ESG rating. Based on evidence from an emerging market, namely China, this paper examines whether ESG is an adequate indicator for firms’ future financial performance. Given the divergence in ESG rating methodologies, we use ESG data from two ESG rating agencies, one based in China (SynTao) and the other based in Switzerland (RepRisk), for robustness. Specifically, we investigate 377 China A-share companies covered by both agencies and find that ESG rating, albeit divergent due to disparate methodologies, is instrumental in predicting the trend of corporate financial performance (CFP). This work verifies that the forward-looking nature of ESG makes it crucial for firms’ long-term valuation and financial performance in emerging markets. Throughout the research, we observe four issues in the current ESG rating process: the opacity and inaccessibility of source data, the obscurity of ESG rating methodologies adopted by rating agencies, the lack of automated pipeline, and the unannounced historical data rewriting. We believe that the public blockchain ecosystem is promising to address these issues, and we propose future research on the ESG framework for blockchain to call for sustainability focus on this emerging technology.

Student Researchers

Haoxin Yu is a rising senior at Duke Kunshan University, majoring in Data Science. He has great passion for data analysis and sustainable finance that may help people solve long-term practical issues. He is mainly responsible for western ESG rating research in this project.

Ziliang (Lewis) Tian is a Senior studying Data Science at DKU. He is passionate about the integration of data science and business, fintech, and other quantitative solutions that help people make more informed decisions with technology. He is particularly interested in the application of data science in ESG and intends to pursue a master’s degree in quantitative finance or fintech.

Research Poster